Estate Planning

Secure Your Family's Financial Future with Estate PlanningEmbrace a brighter tomorrow with a living trust that safeguards your family's future. Experience unmatched peace of mind, sidestep probate, and shield your cherished assets. We understand the importance of protecting what matters most to you, and we are here to guide you every step of the way.With our expertise and personalized approach, we will help you navigate the complexities of estate planning, ensuring that your wishes are honored, and your loved ones are taken care of. Let us empower you to leave a legacy that stands the test of time.

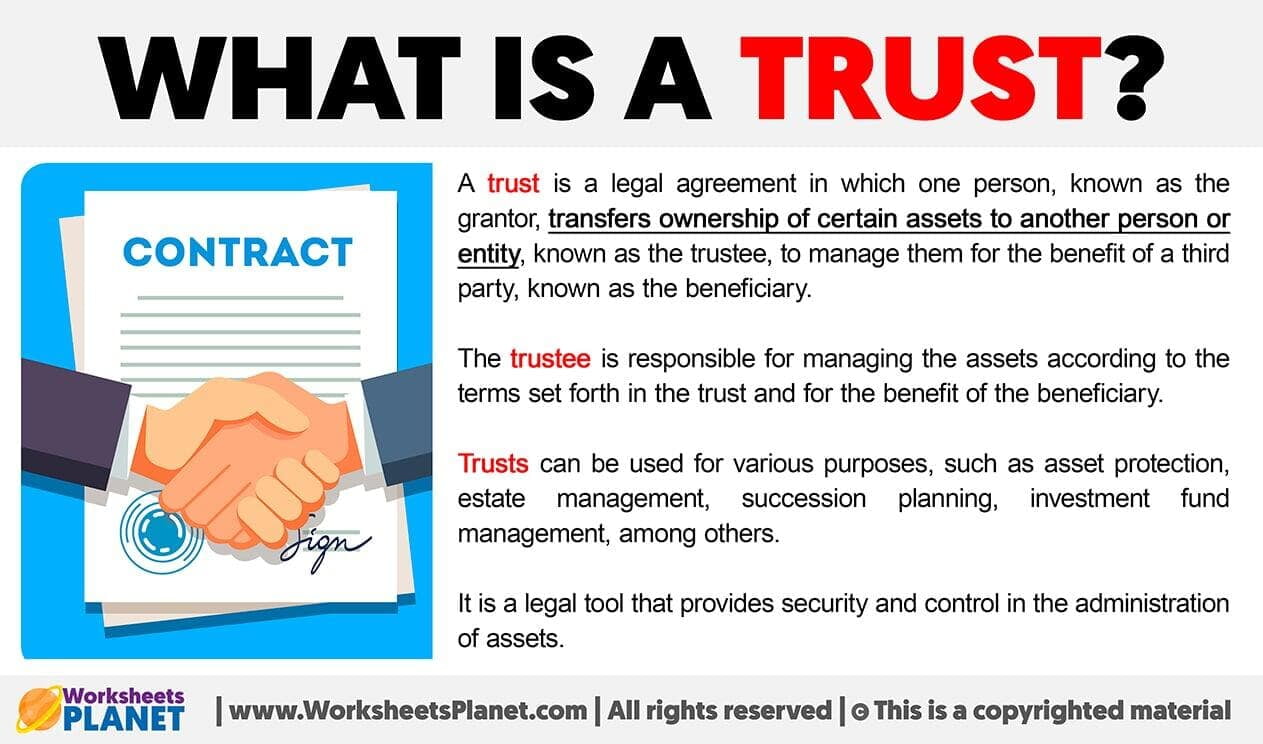

REASONS TO CREATE A TRUST

Reduce Estate Taxes:

Trusts can be an effective way to minimize estate taxes. For example, charitable trusts can offer tax deductions and reduced estate taxes.

Asset Protection:

Avoid Probate:

Trusts can help descendants avoid the probate process, which can be costly, lengthy, and stressful. Because beneficiaries are determined before death, there's no need for a personal representative or executor to make further decisions.

POWER OF ATTORNEY

- Estate planning

You can use a POA to help you make decisions about buying a car, choosing insurance, paying bills, and more

- Convenience

You can use a POA to close transactions without appearing in person, such as when buying or selling assets.

- Incapacity

- Healthcare

You can designate a healthcare agent to make decisions about your medical care, including which doctors to use, where you live, and what you eat.

There are many types of POAs, and some are a good idea to have in place even if you don't expect to need them right away.

ADVANCE HEALTHCARE DIRECTIVE

An advance healthcare directive, also known as a living will, is a written document that allows you to communicate your preferences for health care, including your wishes at the end of life. This can help ensure that your wishes are honored by your family, friends, and healthcare providers, even if you are unable to communicate them yourself due to illness or injury.

Here are some reasons why you might want to have an advance healthcare directive:

- Relieve caregivers

- Reduce confusion

- Provide peace of mind

Planning ahead can help you and your family members feel more at ease, even though these situations can be difficult to think about.

You can contact your healthcare provider, consult with a lawyer, or refer to the Office of the Attorney General's website to learn more about how to create an advance healthcare directive.

THE NEED FOR A WILL

Estate administrationA will can help your estate run smoothly by clearly stating your wishes for how your assets are distributed. It can also help prevent costly disputes over distribution.Asset distributionA will allows you to choose who inherits your assets and how much they receive. You can also keep assets out of the hands of people you don't want to have them, like estranged relatives.GuardianshipA will allows you to choose who will care for your minor children if you die. Without a will, the courts will decide who will take care of them.TaxesA will can help you minimize estate taxes by reducing the value of your estate with gifts to family or charities. You can also specify charitable donations in your will.Funeral instructionsYou can store documented funeral instructions with your will so your loved ones know what you want.